Iowa 529 Limits 2024. The plan is sponsored and. Unlike retirement accounts, the irs does not impose annual.

Allow your savings the potential to grow faster and work harder. In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

For Tax Year 2024, The Roth Ira Contribution Limits Are $7,000 For People Under The Age Of 50.

Unlike retirement accounts, the irs does not impose annual.

One Of The Most Appealing Features Of Saving With A 529 Plan Are The Federal Tax Benefits.

Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

529 Contribution Limits For 2024:

Images References :

Source: www.upromise.com

Source: www.upromise.com

Iowa 529 Plans Learn the Basics + Get 30 Free for College Savings, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary.

Source: julianawnoni.pages.dev

Source: julianawnoni.pages.dev

Iowa 529 Contribution Limits 2024 Nevsa Adrianne, Some plans, including college savings iowa,. What’s the contribution limit for 529 plans in 2024?

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. Unlike retirement accounts, the irs does not impose annual.

Source: atonce.com

Source: atonce.com

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2024, One of the most appealing features of saving with a 529 plan are the federal tax benefits. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

Source: www.collegesavings.org

Source: www.collegesavings.org

529 College Savings Day What's Your State Doing?, A recent change to tax law will. Some plans, including college savings iowa,.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Max 529 Contribution Limits for 2024 What You Should Contribute, One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute. As a participant, you will.

Source: www.youtube.com

Source: www.youtube.com

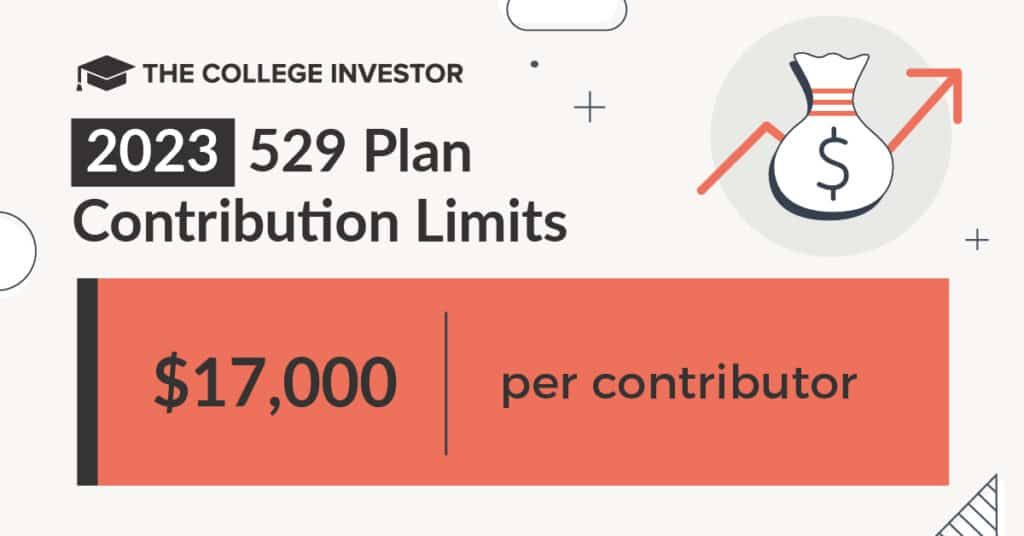

529 Plan Contribution Limits Rise In 2023 YouTube, One of the most appealing features of saving with a 529 plan are the federal tax benefits. Start with as little as $25.

Source: alaneqdoroteya.pages.dev

Source: alaneqdoroteya.pages.dev

Ny 529 Contribution Limits 2024 Basia Carmina, One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute. What’s the contribution limit for 529 plans in 2024?

Source: tybieqcoralyn.pages.dev

Source: tybieqcoralyn.pages.dev

Indiana 529 Contribution Limits 2024 Faythe Cosette, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary. Up to $4,028 in contributions can be deducted.

Source: www.upromise.com

Source: www.upromise.com

529 Plan Infographic, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial. Some plans, including college savings iowa,.

529 Plan Contribution Limits In 2024, In My Home State Of Iowa, Parents (Or Other 529 Account Owners, Like Grandparents) Can Deduct 529 Contributions Of Up To $4,028 From.

In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor.

529 Contribution Limits For 2023.

What’s the contribution limit for 529 plans in 2024?